com's on-line car insurance policy calculator to get our suggestion of what auto insurance policy coverage you should get. It'll additionally advise insurance deductible limitations or if you need coverage for uninsured driver insurance coverage, medpay/PIP, and also umbrella insurance policy. Just how to get inexpensive full protection auto insurance? The ideal means to find the most affordable complete insurance coverage vehicle insurance coverage is to shop your coverage with numerous insurance companies.

Here are a couple of pointers to comply with when looking for economical complete insurance coverage automobile insurance: Ensure you are regular when shopping your responsibility limits. If you select in bodily injury responsibility each, in bodily injury obligation per mishap and in property damage responsibility per crash, constantly go shopping the same insurance coverage degrees with other insurance companies.

These protections belong to a full coverage plan, so a costs quote will be essential for these protections too. Both crash as well as extensive included a deductible, so make certain constantly to pick the exact same insurance deductible when looking for protection. Selecting a greater insurance deductible will certainly press your premium lower, while a reduced insurance deductible will cause a higher costs.

There are other insurance coverages that assist comprise a full insurance coverage bundle. These insurance coverages differ but can consist of: Uninsured/underinsured motorist insurance coverage, Personal injury security, Rental reimbursement insurance coverage, Towing, Gap insurance policy, If you need any one of these additional coverages, constantly choose the very same insurance coverage degrees and deductibles (if they use), so you are comparing apples to apples when going shopping for a new plan - trucks.

Can I drop full protection vehicle insurance policy? Examining our information, we discovered that roughly of chauffeurs that have a lorry at the very least 10-years old are buying comprehensive and also crash coverage. Various other motorists may think about going down these optional insurance coverages as their automobile nears completion of its life. If you can take care of such a loss-- that is, replace a stolen or completed vehicle without a payment from insurance policy-- do the mathematics on the prospective savings as well as consider dropping protections that no more make good sense.

Going down thorough as well as crash, she would certainly pay concerning a year a cost savings of a year - dui. Allow's state her car deserves as the "real money worth" an insurer would certainly pay. If her cars and truck were amounted to tomorrow and also she still lugged full insurance coverage, she would certainly get a check for the car's actual cash money worth minus her deductible.

Not known Incorrect Statements About Does Insurance Follow The Car Or The Driver In California? - Blog

Naturally, the car's value drops with each passing year, and also so do the insurance coverage costs. At a certain point, a lot of vehicle drivers would certainly choose to accept the danger and also bank the collision and comprehensive costs because they would be unlikely to locate a trustworthy replacement with the insurance payment. Complete protection vehicle insurance FAQ's, Exactly how much is full insurance coverage insurance coverage on a new car? There is no details response to this question as premiums can vary significantly depending upon your personal aspects, where you live as well as the kind of auto you are driving.

For instance, Louisiana's typical premium came in at in 2021, which is a surprising 99% greater than the nationwide standard of (prices). Maine has the cheapest complete automobile insurance coverage rate on the various other end of the range, with a typical premium of a year. Exactly how much is full protection insurance for 6 months? Full coverage six-month prices will certainly differ across states as well as various other variables however the nationwide standard for a six-month complete protection plan is.

If you are funding your automobile, your insurance provider will likely require that you lug minimal complete insurance coverage for funded cars and truck to secure their investment in your car. Intend you aren't carrying extensive or collision insurance coverage and also your lorry is ruined in a mishap by a serious weather condition event or various other risk.

Up until you own your car outright as well as can pay for to repair or replace it, if essential, you must be lugging full protection insurance policy (low cost auto). What is taken into consideration complete protection automobile insurance coverage? Technically, there is no such thing as a "complete protection" insurance coverage. The term "full insurance coverage" merely refers to a collection of insurance protections that offer a wide range of defenses, basically, safeguarding your vehicle in "full. "While "full protection" can mean different things to different people, many vehicle drivers take into consideration complete protection auto insurance to include not just mandatory state protections, such as obligation insurance policy however detailed and crash insurance coverages.

That has the most inexpensive full insurance coverage cars and truck insurance coverage? There is no actual way to determine that has the most affordable full insurance coverage cars and truck insurance coverage as insurance policy costs can differ drastically even within the exact same neighborhood. Insurance companies take into consideration a variety of variables when setting a costs, and much of those aspects are personal, so rates can vary substantially between vehicle drivers - automobile.

Constantly make certain you are contrasting apples to apples when it concerns protection degrees and deductibles - suvs.

Getting The The Cheapest Car Insurance In California For 2022 - Moneygeek To Work

Drivers in the Golden State pay an average of $2,065 each year, or concerning $172 monthly, for complete protection automobile insurance policy, according to Bankrate's 2021 study of estimated annual costs (low cost auto). To determine the average price of auto insurance in The golden state, our insurance content team examined typical prices provided by Quadrant Details Provider for metro areas throughout the state.

Vehicle Drivers in Los Angeles pay one of the most without a doubt for automobile insurance coverage, according to our study, with an average rate for complete insurance coverage insurance policy of $2,838 each year, 37% above the state average. The golden state parents adding a 16-year-old driver to their complete coverage vehicle insurance plan can expect an average yearly boost of $3,744 annually.

The ordinary price for state minimum coverage is $733 annually (insurance). While the ordinary car insurance rates in California can help you figure out if you are overpaying for protection, remember that your premium will vary based upon nearly a dozen private ranking variables like the kind of auto you drive, your motor car document, declares history and exactly how numerous miles you drive each year.

cheapest auto auto cheap car

cheapest auto auto cheap car

California auto insurance coverage rates Ordinary yearly minimum insurance coverage costs Typical yearly complete insurance coverage premium $733 $2,065 California car insurance policy rates by city, Auto insurance policy rates in California vary by city. Drivers in largely populated areas tend to have higher prices. Having more automobiles when traveling can suggest a higher opportunity of a mishap.

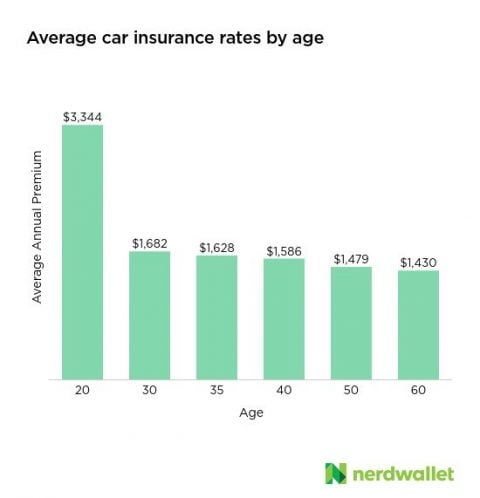

Utilize this chart as an overview to aid determine your general expenses to ensure that you can decide what insurance policy prices fit in your budget plan. California auto insurance coverage prices by age, A chauffeur's age commonly adds to the expense of annual premiums, as it can show exactly how statistically high-risk a motorist is.

The golden state automobile insurance prices by debt rating, In numerous states, your credit-based insurance policy score will influence just how much you pay for vehicle insurance coverage. This is due to the fact that motorists with low credit scores ratings statistically often tend to submit even more claims than vehicle drivers with higher credit report, according to the Insurance coverage Info Institute (Triple-I).

Things about Auto Insurance In California - How It Works - Shouse Law Group

The Triple-I advises you consider purchasing coverage levels over the state minimums for fuller monetary protection - auto insurance. It is very important to keep in mind that the state's minimum insurance coverage does not include any type of protection for your lorry if you are at fault in an accident. If you have a rented or financed vehicle, you will likely require to bring complete coverage, which consists of detailed and also crash.

What is the very best automobile insurer in California? Based on our research, Geico, Progressive, State Ranch and Wawanesa are among the ideal auto insurance coverage firms in California. Nevertheless, the most effective firm for your demands will depend upon what you want as well as need from a vehicle insurance firm. Understanding your preferences and obtaining quotes from a number of various service providers can assist you find the best fit for your situations.

Prices were calculated by evaluating our base account with the ages 18-60 (base: 40 years) applied. For teenagers, prices were figured out by adding a 16- or 17-year-old teen to a 40-year-old wedded couple's policy.

cheap auto insurance money suvs cheapest car insurance

cheap auto insurance money suvs cheapest car insurance

Rates were computed by reviewing our base profile with the following incidents used: tidy document (base), at-fault accident, single speeding ticket, single DUI sentence and also lapse in insurance coverage.

The Triple-I recommends you take into consideration purchasing protection degrees over the state minimums for fuller financial defense. It is very important to note that the state's minimum protection does not consist of any insurance coverage for your lorry if you are at fault in a mishap. If you have a rented or financed cars and truck, you will likely require to lug full protection, that includes thorough and also accident.

What is the finest auto insurer in The golden state? Based upon our research, Geico, Progressive, State Ranch and Wawanesa are amongst the very best vehicle insurance provider in The golden state. The ideal company for your demands will depend on what you want and require from an auto insurance firm - low-cost auto insurance. Understanding your choices and also getting quotes from several various service providers might aid you find the right fit for your conditions.

Some Of Safety Insurance

Prices were computed by examining our base account with the ages 18-60 (base: 40 years) applied. For teens, rates were figured out by adding a 16- or 17-year-old teenager to a 40-year-old married pair's policy.

Prices were calculated by examining our base profile with the complying with incidents used: tidy record (base), at-fault mishap, single speeding ticket, solitary DUI conviction as well as lapse in protection.

The Triple-I recommends you take into consideration buying coverage levels above the state minimums for fuller economic defense. It is crucial to note that the state's minimum protection does not include any kind of coverage for your lorry if you are at fault in a crash (car insurance). If you have a rented or financed cars and truck, you will likely need to bring complete protection, that includes thorough and also crash.

What is the most effective cars and truck insurance coverage company in California? Based on our research study, Geico, Progressive, State Ranch as well as Wawanesa are among the best cars and truck insurance policy firms in California. The ideal company for your demands will depend on what you want and require from a vehicle insurer. Comprehending your choices as well as obtaining quotes from several various providers could assist you find the ideal suitable for your conditions.

These are example rates and should only be used for comparative objectives. Rates were determined by evaluating our base profile with the ages 18-60 (base: 40 years) applied. Relying on age, motorists may be an occupant or property owner. For teenagers, rates were established by adding a 16- or 17-year-old teen to a 40-year-old wedded couple's plan.

Prices were computed by evaluating our base profile with the adhering to events applied: clean record (base), at-fault crash, solitary speeding ticket, solitary drunk driving conviction as well as gap in protection (dui).

Our Cigna Official Site - Global Health Service Company Ideas

The Triple-I advises you take into consideration purchasing coverage levels above the state minimums for fuller financial protection. It is vital to keep in mind that the state's minimum coverage does not include any protection for your car if you are at mistake in a crash. If you have a rented or funded car, you will likely need to lug full protection, that includes comprehensive and collision.

What is the ideal automobile insurance coverage firm in The golden state? Based on our research study, Geico, Progressive, State Farm and also Wawanesa are among the ideal auto insurance policy firms in The golden state.

Prices were determined by examining our base account with the ages 18-60 (base: 40 years) used. For teenagers, prices were determined by adding a 16- or 17-year-old teen to a 40-year-old married pair's plan.

Rates were computed by reviewing our Have a peek at this website base account with the following cases used: tidy record (base), at-fault crash, solitary speeding ticket, solitary drunk driving conviction and also lapse in protection. car insurance.

However, the Triple-I recommends you consider acquiring insurance coverage levels over the state minimums for fuller monetary security. It is very important to keep in mind that the state's minimum protection does not consist of any kind of protection for your lorry if you are at mistake in a crash. If you have a rented or financed car, you will likely require to carry full protection, which consists of comprehensive as well as collision.

What is the very best automobile insurer in The golden state? Based upon our research study, Geico, Progressive, State Farm as well as Wawanesa are amongst the ideal auto insurance provider in The golden state. Nevertheless, the ideal firm for your demands will depend on what you desire and also require from a car insurance company. Understanding your choices as well as obtaining quotes from a number of different service providers might aid you locate the right fit for your circumstances.

Some Known Factual Statements About How Much Auto Insurance Coverage Do I Need?

low cost money insurance low cost auto

low cost money insurance low cost auto

These are example prices as well as need to just be utilized for relative purposes. auto. Prices were determined by evaluating our base profile with the ages 18-60 (base: 40 years) applied. Relying on age, drivers may be a renter or house owner. For teens, prices were identified by adding a 16- or 17-year-old teenager to a 40-year-old couple's policy.

Prices were calculated by examining our base profile with the following events applied: tidy record (base), at-fault mishap, solitary speeding ticket, solitary DUI sentence and also gap in coverage (automobile).